Strategic Asset Allocation

Asset allocation is a fundamental element of our individual and balanced portfolio management. This is important to create long-term and solid excess returns and also to reduce the risk of loss during turbulent times.

Strategic asset allocation

At the strategic level, a long-term investment strategy is formulated (1-5 years). A long-term allocation is made among the selected asset classes, and an investment benchmark is chosen. At the strategic level, our starting point is sophisticated mathematical algorithms supplemented with our insight and experience.

Tactical asset allocation

At the tactical level, the investment horizon is most often less than one year. The basis for tactical asset allocation is our understanding of the current economic climate coupled with insight into the development of different asset classes across the economic cycle.

CLI-model

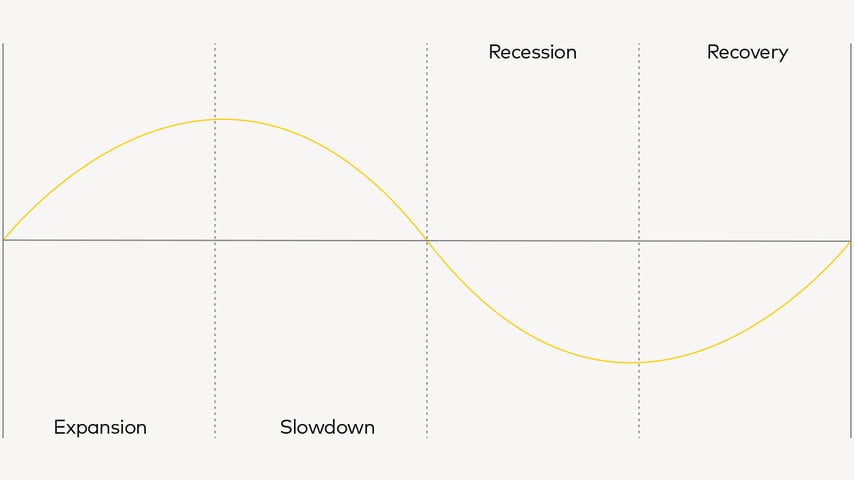

The CLI model is used to understand and assess the economic climate. Using the CLI model, economic trends are divided into four phases:

- Expansion

- Slowdown

- Recession

- Recovery

The financial returns fluctuate with the economic seasons, and the CLI model provides an understanding of economic trends which forms the basis for defining the tactical allocation.

Risk management

Risk analysis is key in ensuring that portfolio managers and investors have the skills required for making a given investment. For some time, Nykredit Asset Management has studied and applied risk management and risk modelling as a separate discipline.

In general, asset management used to be about offering investors the highest possible returns relative to a given risk profile. In recent years, however, the financial sector has learned that measuring risk is one thing, but understanding risk ratios and not least reacting in time is a totally different ball game.

Risk management and modelling – a separate discipline

Risk analysis is key in ensuring that portfolio managers and investors have the skills required for making a given investment.

Focus on both sides of the coin

Obviously, we focus on return potential, but we also consider the risk factors affecting returns. The message is the same, but we look at both sides of the coin, so to speak, as return potential must never go without a risk assessment.